Learn how to write a business plan for your small business today. Download our business plan template and follow our 10-step plan with easy-to-ready samples. Whether you’re a founder, a new owner, or just beginning to think about starting a business , demands come at you fast. Tasks, to-do lists, meetings, and more.

Amidst that rush, the idea of writing a business plan—much less following a business plan template—often feels time-consuming and intimidating.

Done right, however, the payoffs are enormous. It’s more than the old cliché, “A failure to plan is a plan to fail.”

In fact, a wealth of data now exists on the difference a written business plan makes. Especially for small or growing companies. Perhaps the strongest evidence comes from the Journal of Business Venturing’s “meta-analysis” of 46 separate studies on 11,046 organizations.

For anyone wanting to wade through all 4,000 words, spoiler alert:

Our findings confirm that business planning increases the performance of both new and established small firms.

In this post, we’ll cover everything you need to write a successful business plan and turn your idea into a reality. Even better—if you’re pressed for time—we’ve compiled the 10 steps and examples into a downloadable (PDF) template.

Learn more about writing your business plan in the QuickBooks Start Your Business series:

A business plan is a comprehensive roadmap for your small business’ growth and development. It communicates who you are, what you plan to do, and how you plan to do it. It also helps you attract talent and investors.

But, bear in mind, a business idea is not a plan.

Templated business plans give investors a blueprint of what to expect from your company and tell them about you as an entrepreneur. The majority of venture capitalists (VCs) and all banking institutions will not invest in a start-up or small business without a solid, written plan.

Investors want to know you have product-market fit, a solid team in place, and scalability—which is the ability to grow sales volume without proportional growth in headcount and fixed costs.

Before you leave a 9-to-5 income, your business plan can tell you if you’re ready. Over the long term, it’ll keep you focused on what needs to be accomplished.

It’s also smart to write a business plan when you’re:

Start with a clear picture of who the audience your plan will address.

Is it a room full of angel investors? Your local bank’s venture funding department? Or, an internal document to guide you, your leaders, and your employees?

Defining your audience helps you determine the language you’ll need to propose your ideas as well as the depth to which you need to go to help readers conduct due diligence.

Even though it appears first in the plan, write your executive summary last so you can condense essential ideas from the other nine sections.

For now, leave it as a placeholder. Of course, this begs the question:

What is an executive summary?

The executive summary lays out all the vital information about your business within a relatively short space; typically, one page or less. It’s a high-level look at everything and summarizes the other sections of your plan.

How do I write an executive summary?

Below, you’ll find an example from a fictional business, Landscapers Inc. (We’ll use that same company through this guide and within the downloadable template to make each step practical and easy to replicate).

Its executive summary majors on what’s often called the value proposition or unique selling point: essentially, an extended motto aimed at customers, investors, and employees.

You can follow a straightforward “problem, solution” format, or a fill-in-the-blanks framework:

That framework isn’t meant to be rigid, but instead to serve as a jumping-off point.

Market research indicates an increasing number of wealthy consumers in Vancouver are interested in landscape architecture based on sustainable design. However, high-end firms in the area are scarce. Currently, only two exist—neither of which focuses on eco-friendly planning, nor are they certified by green organizations.

Landscapers Inc. provides a premium, sustainable service for customers with disposable incomes, large yards, and a love of nature.

Within a business plan, your company description contains three elements: (1) mission statement, (2) history, and (3) objectives.

What is a mission statement?

A mission statement is your business’ reason for existing. More than just what you do or what you sell … it’s about why .

Mission statements should be inspirational and emotional.They should be rallying cries around which the heart and soul of your business turn. Throughout every part of your plan, less is more. Nowhere is that truer than your mission statement.

Think about what motivates you, what causes and experiences led you to start the business, the problems you solve, the wider social issues you care about, and more.

How do you describe a company’s history?

Don’t worry about making your company history a dense narrative. Instead, write it like you would a profile:

Then, translate that list into one or two paragraphs (see below).

Why do business objectives matter?

Business objectives give you a north star. These goals must be SMART: specific, measurable, achievable, realistic and time bound. Or, they must be tied to key results.

When your objectives aren’t clearly defined, it’s hard for employees and team members to work towards a common purpose.

Worse, fuzzy goals won’t inspire confidence from investors. Nor will they have a profitable impact on your business.

Landscape Inc.’s mission is to change the face of our city through sustainable landscaping and help you create the outdoor living space of your dreams.

Founded in 2019 by sisters Sherry and Shelly Smith, we have over 25 years of combined landscape-architecture experience. Our four employees work in teams of two and have already completed ten projects for some of Vancouver’s most influential business and community leaders.

Our objectives over the next three years are to:

Note: Review your mission statement often to make sure it matches your company purpose as it evolves. A statement that doesn’t fit your core values or what you actually do can undermine your marketing efforts and credibility.

The next step is to outline your ideal customer as well as the actual and potential size of your market.

Target markets—also known as personas—identify demographic information like:

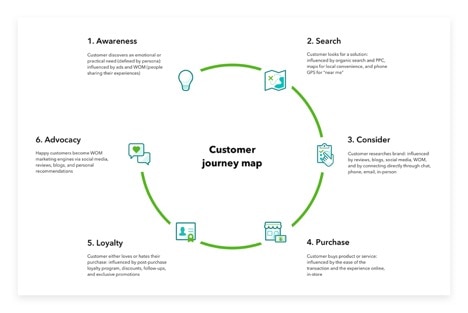

You can get even more targeted by mapping your customer’s journey:

If your target market is too broad, it can be a red light for investors.

For example, if your product is perfect for people with money to hire landscape architects, listing “anyone with a garden” as your target market might not go over so well.

The same is true with your market analysis when you estimate its size and monetary value. In addition to big numbers that encompass the total market, drill down into your business' addressable market; meaning, local numbers or numbers that apply the grand total to your specific segments.

Landscapers Inc.’s ideal customer is a wealthy baby boomer or a member of Gen X between the ages of 35 and 65 with a high disposable income. He or she—though primarily, she—is a homeowner. They’re a working professional or recently retired.

In love with the outdoors, they want to enjoy the beauty and serenity of nature in their own backyard—but don’t have the time or skill to do it for themselves.

Market research shows the opportunity for Landscape Inc. has never been better:

In Vancouver, leading indicators for interest in green, eco-friendly, and sustainable landscaping have all increased exponentially over the last five years:

Competitive research begins with identifying other companies that currently sell in the market you’re looking to enter. The idea of carving out enough time to learn about every potential competitor you have may sound overwhelming, but it can be extremely useful.

Answer these additional questions after you’ve identified your most significant competitors:

When visiting your competitor’s websites, take a look at their “About Us” page, or their mission and values statement.

If you’re presenting to a panel of investors, distinguishing yourself from competitors is one of the most critical pieces of your business plan.

If you haven’t done your homework, those investors will see right through you. Spend some time thinking about what sets you apart. If your idea is truly novel, be prepared to explain the customer pain points you see your business solving. If your business doesn’t have any direct competition, research other companies that provide a similar product or service.

Next, create a table or spreadsheet listing your competitors to include in your plan. Your business should be listed last, on the right which is standard practice. This is often referred to as a competitor analysis table.

Within Vancouver’s residential landscaping market, there are only two high-end architectural competitors: (1) Yard Makers and (2) Design Your Landscape. All other businesses focus solely on either industrial projects or residential maintenance.

Design Your Landscape

This section distills the benefits, production process, and lifecycle of your product or service … and how what your business offers is better than your competitors.

When describing benefits, focus on:

For the production process, answer how you:

Within the product lifecycle portion, map elements like:

Landscaping Inc.’s service—our competitive advantage—is differentiated by three core features.

First, throughout their careers, Sherry and Shelly Smith have worked at and with Vancouver’s three leading industrial-landscaping firms. This gives us unique access to the residents who are most likely to use our service.

Second, we’re the only firm certified-green by the Vancouver’s Homeowners Association and the National Preservation Society.

Third, of our ten completed projects—from 2018 and 2019—seven have rated us a 5 out of 5 on Google My Business and our price-points for those projects place us within a healthy middle ground between our two other competitors.

Your marketing strategy can be the difference between selling so much that growth explodes or getting no business at all.

Growth strategies here are a critical part of your business plan. You should briefly reiterate topics such as your:

You can also use this section of your business plan to reinforce your strengths and what differentiates you from the competition. Be sure to show what you’ve already done, what you plan to do given your existing resources, and what results you expect from your efforts.

Landscapers Inc.’s marketing and sales strategy will leverage—in order of importance:

Reputation is the number one purchase influencer in high-end landscape design. As such, channels 1-4 will continue to be our top priority.

Our social media strategy will surround YouTube videos of the design process as well as multiple Instagram accounts and Pinterest boards showcasing professional photography. Lastly, our direct mail campaigns will send carbon-neutral, glossy brochures to houses in wealthy neighborhoods.

If you’re just starting out, your business may not yet have financial data (statements) or comprehensive reporting . However, you’ll still need to prepare a budget.

If your company has been around for a while and you’re seeking investors, be sure to include:

Other figures that can be included are:

Ideally, provide at least three years’ worth of reporting. Make sure your figures are accurate and don’t provide any profit or loss projections before carefully going over your past statements for justification.

Costs, profit margins, and sale prices are closely linked, and many business owners set sale prices without accounting for all costs.

New business owners are particularly at risk for this mistake.The cost of your product or service must include all of your costs, including overhead. If not, you can’t determine a sale price to generate the profit level you desire.

Underestimating costs can catch you off-guard and eat away at your business over time. Insurance premiums tend to go up annually for most forms of coverage, and that’s especially true with business insurance. If an employee gets injured, Landscapers Inc.’s workmen’s compensation insurance to cover this risk will increase.

Given the high degree of specificity required to accurately represent your business’ financials, rather than create a fictional line-item example for Landscaping Inc. learn how to create business financials here:

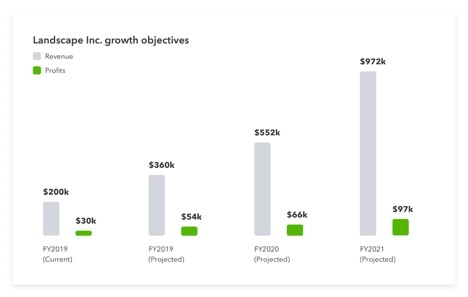

Once you’ve completed either one, only then create a big-picture representation to include here as well as in your objectives in step two .

In the case of Landscape Inc., this big-picture would involve steadily increasing the number of annual projects and cost per project to offset lower margins.

Current revenue for FY2019: $200,000

FY2019 projections: $360,000

FY2020 projections: $552,000

Your business is only as good as the team that runs it.

Identify your team members and explain why they can either turn your business idea into a reality or continue to grow it.

This section of your business plan should show off your management team superstars. Highlight expertise and qualifications throughout.

Also, mention the roles you still need to hire to grow your company and the cost of hiring experts. To make informed business decisions, you may need to budget for a CPA and an attorney.

CPAs can help you review your monthly accounting transactions and prepare your annual tax return. An attorney can help with client agreements, investor contracts (like shareholder agreements) and with any legal disputes that may arise.

Ask your business contacts for referrals (and their fees) and include those costs in your business plan.

Sherry Smith, Co-founder and CEO

Shelly Smith, Co-founder and Chief design officer

Landscape Inc.’s creative crews

It’s important to outline how much money your small business needs, so you can make an accurate funding request. Try to be as realistic as possible.

You can create a range of numbers if you don’t want to pinpoint an exact number.

However, include a best-case scenario and a worst-case scenario.Since a new business doesn’t have a track record of generating profits, it’s likely that you’ll sell equity to raise capital in the early years of operation.

Equity means ownership: when you sell equity to raise capital you are selling a portion of your company. Keep in mind, an equity owner may expect to have a voice in company decisions, even if they do not own a majority interest in the business.

Most small business equity sales are private transactions. The investor may also expect to be paid a dividend, which is a share of company profits, and they’ll want to know how they can sell their ownership interest.

Additionally, you can raise capital by borrowing money, and you’ll have to repay creditors both the principal amount borrowed and the interest on the debt.

If you look at the capital structure of any large company, you’ll see that most firms issue both equity and debt. When drafting your business plan, decide if you’re willing to accept the trade-off of giving up total control and profits before you sell equity in your business.

You should also put together a timeline, so your potential investors have an idea of what to expect. Some customers may not pay for 30 days or longer, which means the business needs a cash balance to operate.

The founder can access cash by contributing his own money into the business, by securing a line of credit (LOC) or at a bank. If they raise cash through a LOC or some other type of loan, it needs to be paid off ASAP to reduce the interest cost on debt. Learn more in our guide to the top Canadian small business loans .

Landscape Inc. has already purchased all necessary permits, software, and equipment to serve our existing customers.

Once scaled to $972,000 in annual revenue—over the next three years and at a 10% profit margin—our primary ongoing annual expenses (not including taxes) will total: